All Markets Collapsing

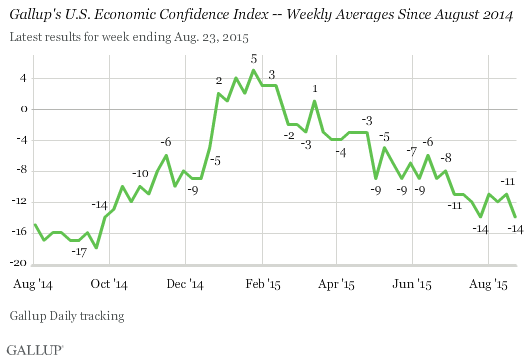

WASHINGTON, D.C. — Gallup’s Economic Confidence Index was -14 for the week ending Aug. 23, down slightly from -11 the week prior. Growing concerns about China, which devalued its currency and saw major losses in its stock market, led to a global stock sell-off, including in the U.S., where the Dow Jones declined by more than 500 points by market close on Friday.

This is the second time in the past two months in which an international economic event appears to have modestly affected U.S. stocks as well as economic confidence. Last month, as the Greek debt deal was being finalized, U.S. economic confidence also dropped to -14, matching the latest week’s reading as the 2015 low and the worst weekly score since September 2014.

Gallup’s Economic Confidence Index reached positive territory for the first time since 2008 in late December 2014. It remained there until late February, when it began dropping as U.S. gas prices began to rise.

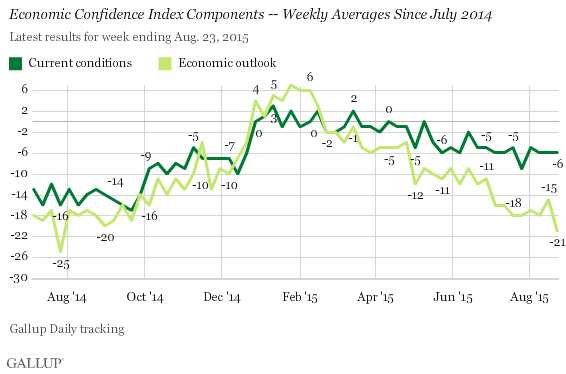

The Economic Confidence Index is the average of two components: how Americans rate current economic conditions and whether they feel the economy is getting better or worse. The index has a theoretical maximum of +100, if all Americans rate the economy as good and getting better, and a theoretical minimum of -100, if all Americans rate the economy as poor and getting worse.

Americans’ perceptions of the economy’s direction became more pessimistic last week, as the outlook component score fell six points to -21, the lowest weekly average since the end of July 2014. This latest average was the result of 37% of Americans saying the economy is “getting better” and 58% saying it is “getting worse.”

The current conditions score was stable last week, averaging -6, similar to what has been found most weeks since late May. This was the result of 24% of Americans rating the current economy as “excellent” or “good” while 30% rated it as “poor.”

Bottom Line

China, the second-largest economy in the world and a major exporter of goods to the U.S. and other countries, has experienced tremendous economic growth in recent years. Now, with the Chinese economy showing signs of weakness, and its government responding by devaluing its currency, investors abroad are showing concern. The questions surrounding China’s economy appear to be a major reason for losses in the global markets, including in the U.S. To date, Americans’ economic confidence does not appear to have been greatly shaken by the events, but the current index score ties the lowest reading this year.

The situation in China may continue to reverberate in the U.S., with U.S. stocks closing much lower on Monday and European markets starting the week with large drops. To the extent stock markets continue to suffer, particularly if this affects broader aspects of the economy, Americans’ confidence could be shaken further in the coming week.

These data are available in Gallup Analytics.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted Aug. 17-23, 2015, on the Gallup U.S. Daily survey, with a random sample of 3,554 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±2 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.